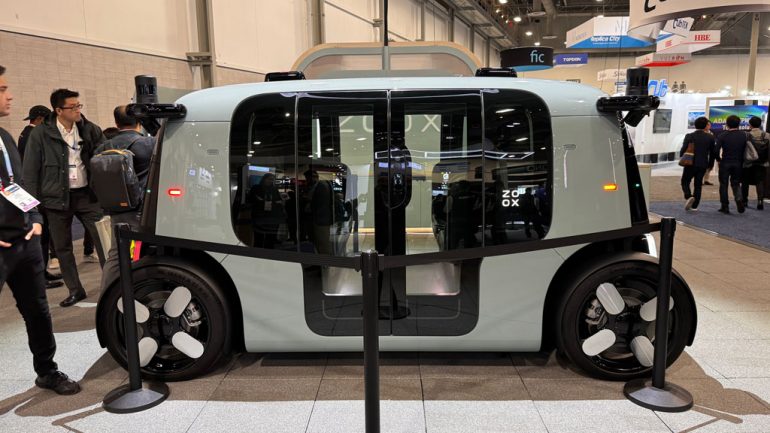

The Consumer Electronics Show (CES) 2024 highlighted the increasing role of artificial intelligence (AI) as the driving force behind the automotive industry. Established automakers are intensifying their efforts to catch up with digital features that have set companies like Tesla and BYD apart, signaling a shift towards what the industry terms “software-defined vehicles.”

Unlike the traditional focus on horsepower and towing capabilities, the contemporary automotive landscape places a significant emphasis on software-driven enhancements. More than a decade after Tesla introduced cars with upgradable over-the-air software, mainstream automakers are still striving to develop similar capabilities.

Also, don’t forget that you can get discounted new car pricing with a free quote through qualified local dealer partners.

The transition to software-dominated cars presents a unique set of challenges. Vehicles must meet higher standards for durability and safety compared to consumer electronics, and the fast-paced evolution of AI systems like ChatGPT poses a challenge due to their error-prone nature and rapid development cycles.

Mercedes-Benz has ventured into a “beta program” to test ChatGPT AI technology, aiming to facilitate natural dialogues between drivers and the vehicle’s infotainment systems. This departure from traditional testing methods signifies a broader shift in the industry. Mercedes is not only allowing customers to test a system under development but is also adapting its IT infrastructure, manufacturing lines, and dealership processes to accommodate faster software updates.

Efforts by established automakers to match technology industry software capabilities have incurred substantial costs, with occasional setbacks. General Motors faced challenges with the Chevrolet Blazer EV due to software-related glitches, leading to a temporary halt in sales. In contrast, Tesla’s use of over-the-air updates exemplifies a more seamless approach to software revisions.

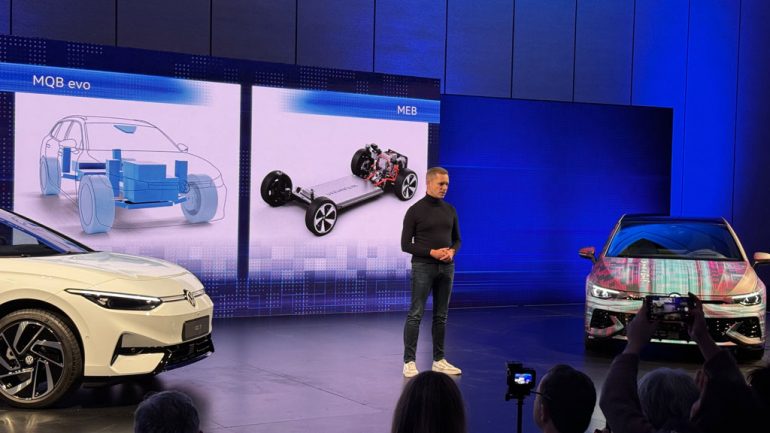

The challenge to develop software architectures comparable to Tesla’s capabilities has been described as a “steep challenge” by industry experts. Volkswagen, after restructuring its Cariad software operation, is now seeking technology industry partnerships to expedite its efforts.

At CES, Volkswagen announced a collaboration with Cerence, a U.S. software developer, to integrate ChatGPT into its cars later in the year. Chinese automakers are also making significant strides in the AI-driven EV market, with in-vehicle displays offering advanced infotainment functions.

To stay competitive, Japanese automaker Honda formed a joint venture with Sony in 2022. The Sony Honda Mobility venture aims to combine Honda’s vehicle engineering experience with Sony’s software and gaming expertise for a new line of EVs set to launch in 2025.

However, the challenge extends beyond development to consumer adoption. While some automakers are introducing subscription fees for software-powered features, consumer willingness to pay for such features remains a concern. Analysts and industry executives suggest that the window for adding fees for new software functions is limited, emphasizing the importance of meeting consumer demands within the next three to five years.

Source: