The 2023 J.D. Power Initial Quality Study has been released, unveiling a concerning trend in the automotive industry. While there are signs of improvement in vehicle inventory, pricing, and the supply chain, the study highlights a decline in vehicle quality compared to the previous year.

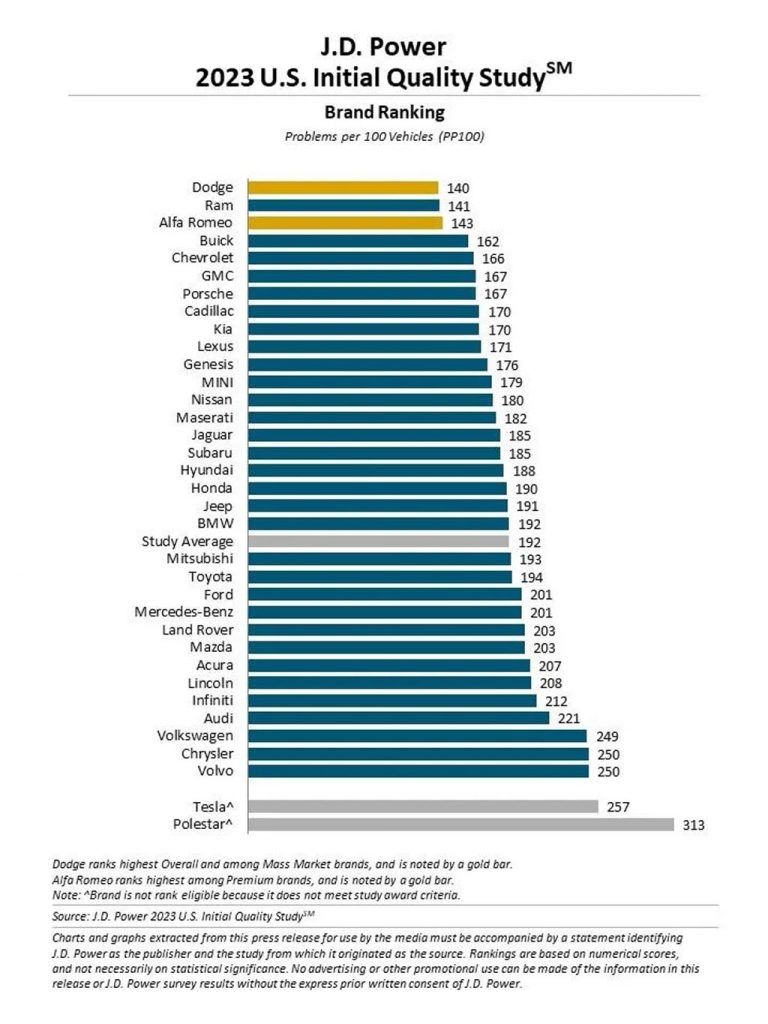

The study, which surveyed owners of 2022-model-year vehicles, aimed to assess the average rate of problems per 100 vehicles (PP100) during the first 90 days of ownership. Unfortunately, the results showed that overall problems exceeded the previous year’s record high. In 2020, the average was about 166 problems per 100 vehicles, which dropped to 162 in 2021. However, for 2022, the average increased to 180 problems, and in 2023, it rose further to an industry average of 192 PP100—an alarming increase of 30 problems per 100 vehicles in just two years.

Also, don’t forget that you can get discounted new car pricing with a free quote through qualified local dealer partners.

On a positive note, Dodge emerged as the brand with the lowest number of problems per 100 vehicles at 140, reclaiming the crown from last year’s winner, Buick. Dodge’s success contributes to parent company Stellantis securing three wins in four years. The top 10 brands include Dodge, Ram, Alfa Romeo, Buick, Chevrolet, GMC, Porsche, Cadillac, Kia, and Lexus. Notably, Maserati showed significant improvement, as did Alfa Romeo, which surpassed premium-class competitors like Porsche and Cadillac.

However, the industry is not without its challenges, as highlighted by Frank Hanley, the senior director of auto benchmarking at J.D. Power. He emphasized that the automotive industry is at a crucial crossroad, with manufacturers facing persistent problems from previous years and an increase in new types of problems. Modern vehicles, while incorporating exciting technologies, are becoming more complex and may not always satisfy owners.

The study revealed that infotainment remains a consistent source of problems, but this year, issues with features gained prominence. Surprisingly, some seemingly simple features, such as door handles, became problematic, especially in electric vehicles (EVs). Lane departure warning and forward collision/automatic emergency braking systems were also frequently cited issues. Notably, vehicles equipped with Google’s Android Automotive Operating System showed a significant difference of 25.1 PP100 compared to those without the software.

Despite these challenges, owners expressed slightly higher satisfaction with manufacturer smartphone apps. In the electric vehicle segment, Tesla, Lucid, Polestar, and Rivian could not be officially ranked due to a lack of access to owners in states requiring manufacturer consent. However, survey responses suggested that these brands would have been at the bottom of the list, with Tesla’s PP100 increasing from 240 in 2022 to 257 in 2023.

The 2023 J.D. Power Initial Quality Study points to a critical juncture for the automotive industry, urging manufacturers to address both persistent and emerging issues to ensure the satisfaction of increasingly discerning vehicle owners. View the full study at J.D. Power’s website here.