Finding an electric vehicle (EV) for a test drive and purchase can be a challenging task unless you have a clear idea of what you want and are prepared to make a financial commitment and wait. The Sierra Club recently conducted a nationwide study on the electric vehicle shopping experience, and their findings emphasize the widespread nature of this issue and its hindrance to EV adoption.

The report, titled “Rev Up Electric Vehicles,” was released just before EPA hearings on proposed stricter standards for light vehicles until 2032, which could lead to a projected 67% increase in EV sales by that time. Interestingly, the report suggests that the weak link in the availability of EVs to customers is no longer the dealerships but the automakers themselves.

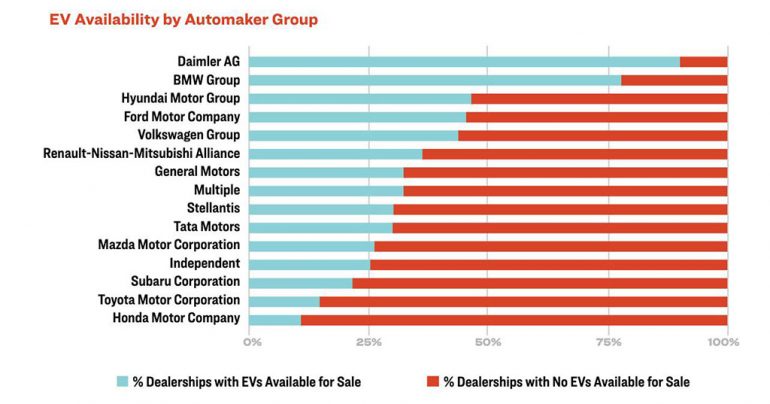

According to the study, almost two-thirds of dealerships surveyed did not have a single EV for sale. Additionally, 44% of the dealerships expressed their willingness to offer EVs for sale if they could acquire them. The western region that accounted for 45% of U.S. EV sales in 2022, only 27% of dealerships had an EV available for purchase.

Surprisingly, even in California Zero-Emission States (ZEV), where EV sales are significantly higher as a group, the likelihood of dealerships having EVs in stock was only slightly higher than in the rest of the country—35% versus 33%, respectively.

The study also found that there was essentially no difference between dealerships in states that permit direct sales and those that do not. The results of the study were based on a national survey conducted from June to November 2022, using data from randomly selected dealerships in each state. Notably, Mercedes-Benz was ranked as the brand with the best EV availability, with EVs for sale at 90% of its dealerships, while Toyota and Honda were ranked the worst, with only 15% of Toyota dealerships offering EVs.

EV Availability – 2023 Sierra Club Rev Up Study

The report’s conclusion is straightforward: automakers need to produce more EVs. It suggests that automakers should make EV certification free or affordable for dealerships, increase marketing and advertising efforts for EVs, and deliver more EVs to all dealers. While some dealerships still hesitate to fully embrace EVs, the report acknowledges that many dealers are becoming more eager to sell them. However, the responsibility lies with the manufacturers to meet the increasing consumer demand, which is currently at a record high.

The obstacles to EV sales have changed significantly over time. In the survey’s inaugural version in 2016, dealerships lacked general knowledge about EVs and showed little interest in selling them. The 2019 version revealed that the EV sales experience faltered at the dealership level, with many dealerships ill-prepared to sell EVs. Now, dealerships are no longer the primary bottleneck in the process. It is crucial to note that households determined to buy an EV are more likely to postpone their purchase than settle for a traditional gasoline or diesel model. In a study from Consumer Reports’ advocacy arm highlighted that the constrained supply of EVs will reduce the potential market for combustion vehicles, leading to a decreased market share for automakers that are slow to ramp up EV production.

In the midst of an emerging EV price war, automakers must swiftly overcome supply chain challenges and reduce production costs. Undoubtedly, dealerships are eagerly awaiting this transformation in order to meet the increasing demand for EVs in the market.

Mike Floyd is a finance executive by trade and a car enthusiast at heart. As a CFO with a keen eye for detail and strategy, Mike brings his analytical mindset to the automotive world, uncovering fresh insights and unique perspectives that go beyond the surface. His passion for cars—especially his favorite, the Porsche 911, fuels his contributions to Automotive Addicts, where he blends a love for performance and design with his professional precision. Whether he’s breaking down industry trends or spotlighting emerging innovations, Mike helps keep the site both sharp and forward-thinking.